31.07.2012

Web sockets provide a reliable and easy-to-implement way to connect web clients with business applications which use messaging queues for inter-module communication.

Web sockets provide a reliable and easy-to-implement way to connect web clients with business applications which use messaging queues for inter-module communication.

This approach may also reduce costs for integration and end user client by using an existing infrastructure. We were very excited with using web sockets for the ChoiceTrade trading platform (they are used for real-time market data streaming) and for TraderOS platform, where WS and HTML5 replaced Silverlight charting and native sockets, based on existing market data feed provider. Applications may also benefit from establishing a connection between clients without a web server using the WS server as a real stand-alone messaging service. Developers of HTML-based clients may also save money and time, re-using and sharing JavaScript code and messaging standards with the desktop version to deliver applications to clients quickly.

This articles shows common ways to use web sockets in web applications, summarizing existing experience in web development and creating multi-module applications. Developing a new application or re-usage of existing components and services have required different solutions, which are shown in the article, but regardless, applications, using web browser as front-end platform, will benefit from using web sockets.

Web sockets provide a reliable and easy-to-implement way to connect web clients with business applications which use messaging queues for inter-module communication.

This approach may also reduce costs for integration and end user client by using an existing infrastructure. We were very excited with using web sockets for the ChoiceTrade trading platform (they are used for real-time market data streaming) and for TraderOS platform, where WS and HTML5 replaced Silverlight charting and native sockets, based on existing market data feed provider.

The full article is available at our Technology Newsletter.

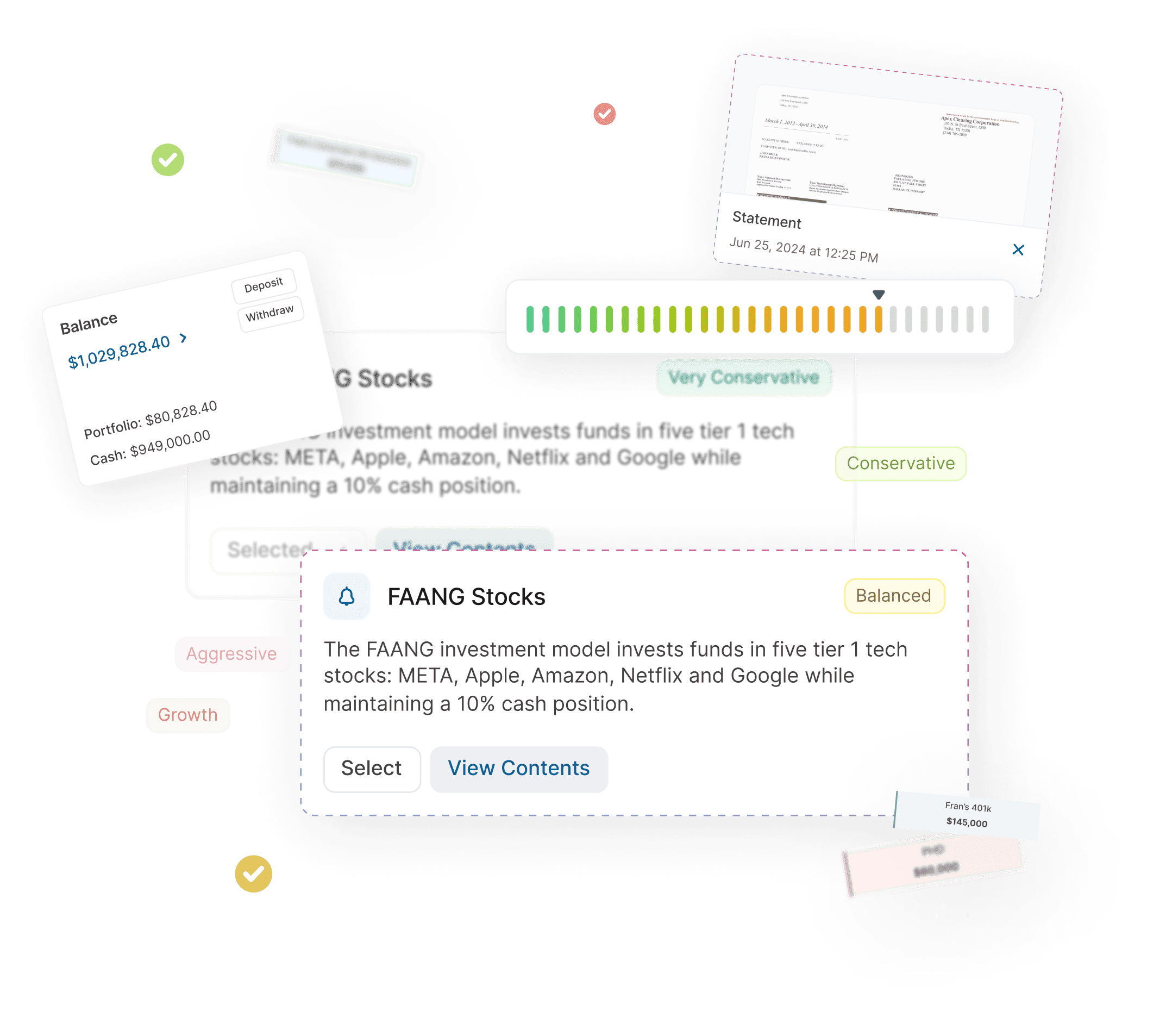

Demo RIA Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

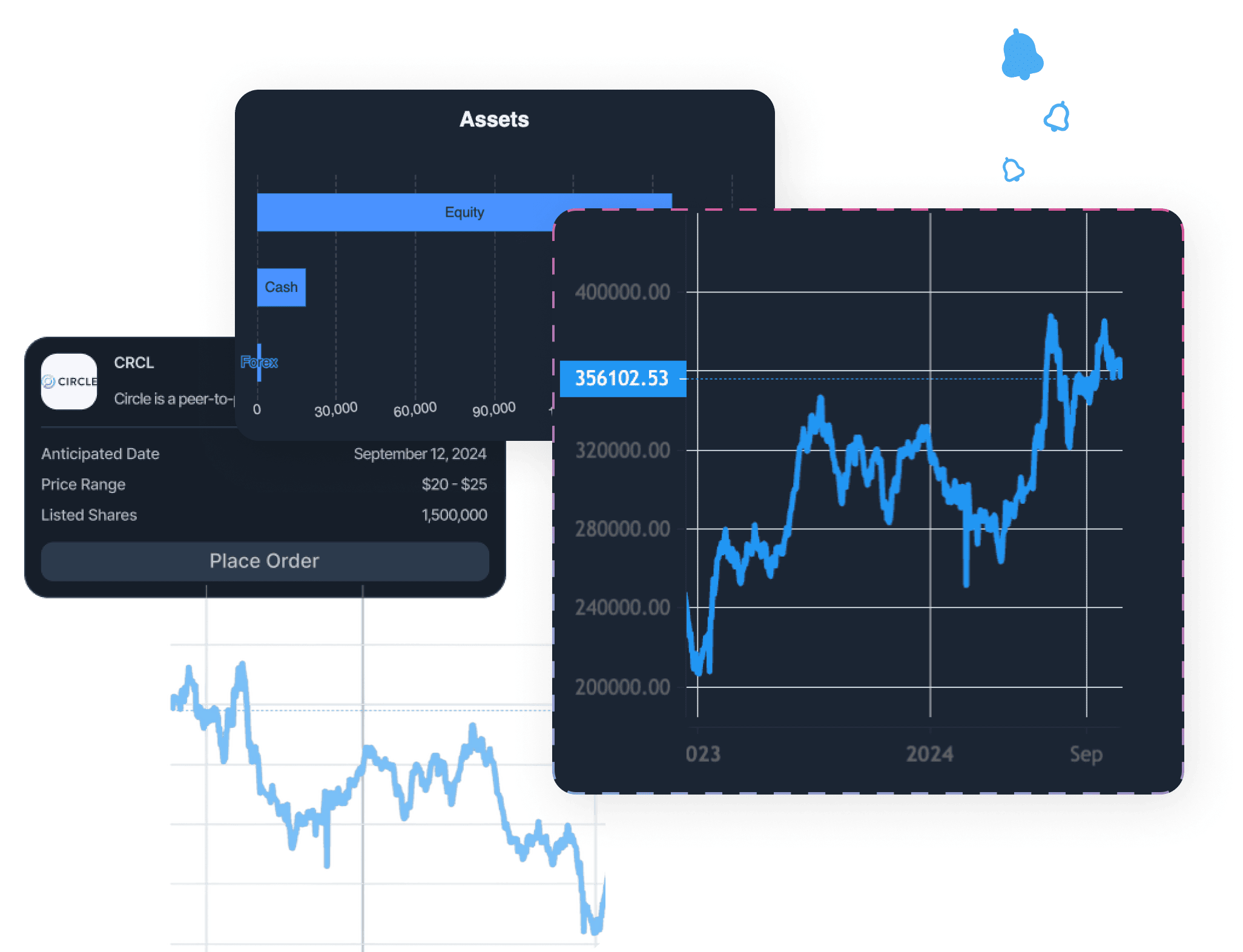

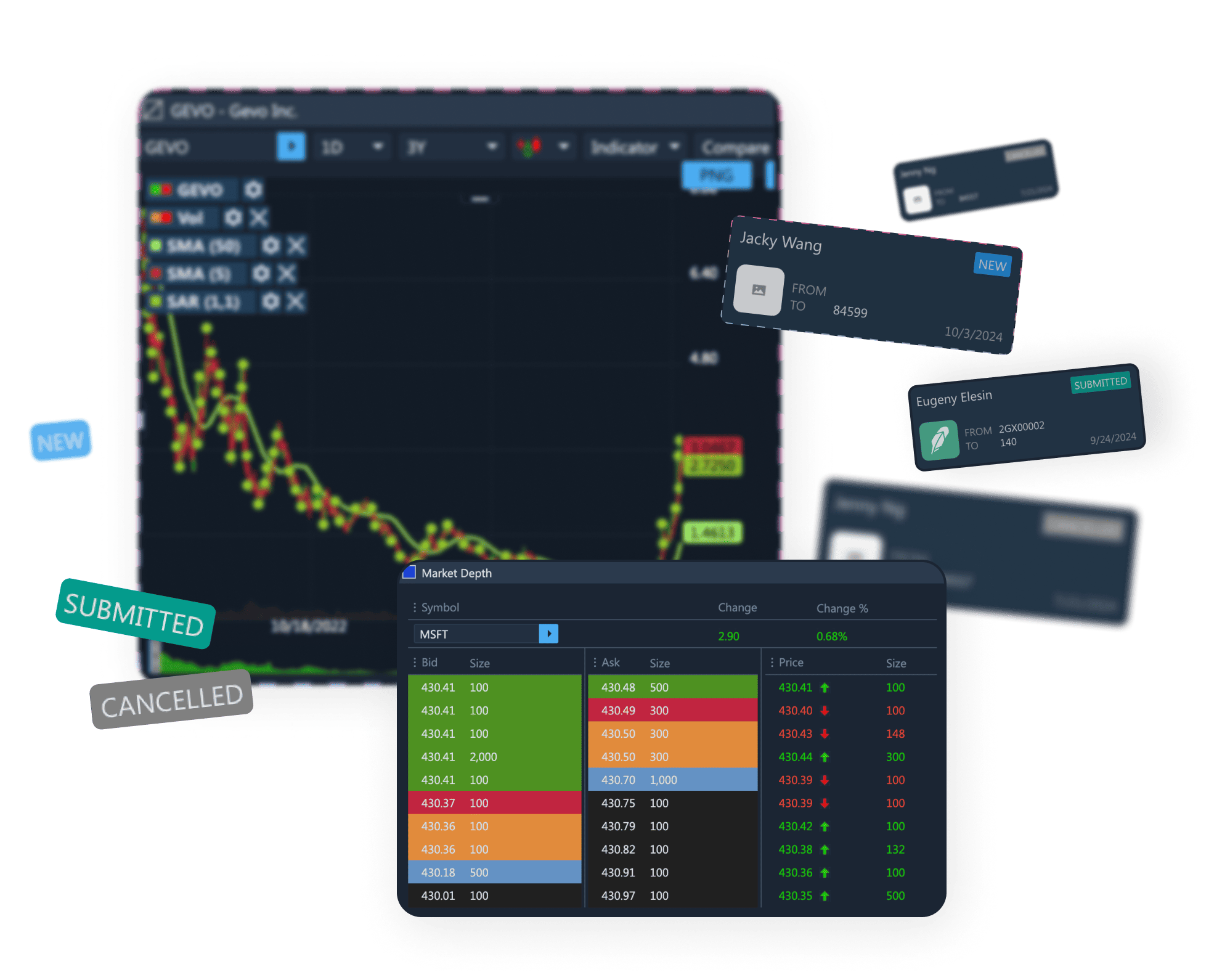

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.