21.08.2012

The glitch that happened with Knight Capital’s algo trading robot can be called the tip of the iceberg. The same sort of situations happen every day, but with less dramatic effect, with many algo strategies. The main reasons for these situations are:

The glitch that happened with Knight Capital’s algo trading robot can be called the tip of the iceberg. The same sort of situations happen every day, but with less dramatic effect, with many algo strategies. The main reasons for these situations are:

If we talk about quality assurance, the algo system must be tested twice as much as any other financial software. Example: for credit cards processing, due to the complexity of the algo, because the cost of failure is too great and it is impossible to cancel the trade once it is made.

Every millisecond the algo robot needs to handle a huge information flow. Any error in the information it receives from the market or error in the algo can lead to opening an incorrect position. Taking into an account that many strategies don’t look at the current P/L status when they make a decision, the chance that the algo will be looped and loose the money exists.

Also, there are rapid market behavior changes and regulatory changes that all influence the development timeframe for coding algos.

Nowadays, more than 70% of all trades are made by algo robots of some kind. The increase in the trading volumes by robots eventually leads to more mistakes made by them. Algorithm acts like a set of instructions – a condition when opening the position, a condition when increasing/decreasing the position and a condition when closing the position. Algorithm does not take into account that his actions may affect the market.

And when something goes wrong from the human point of view, everything is ok from the algorithm point of view (or more – maybe it decides it’s time to buy more and more stocks).

One of the ways to overcome these threats will be to make certain regulations at the exchange for robots that are registered on the exchange; but that will lead to more complex trading infrastructure and could lead to failures because of this complexity. It is also not wise to extend the algo testing period too much since the price of producing the algo will become more than the profit it generates. Furthermore many algos are created to trade for a pretty short period of time and don’t cost very much.

From our point of view, the optimum solution will be for all algo trading companies to use professional software development teams that are experienced in trading and can design a risk free algo code from the very beginning before even coding the algo strategy. All fail critical algo strategies must be heavily monitored to have a threshold for the number of transactions, trade volume, price difference, and many other parameters that imitate the human way of decision making and market analysis.

Roman Zhukov, CEO at ETNA Software

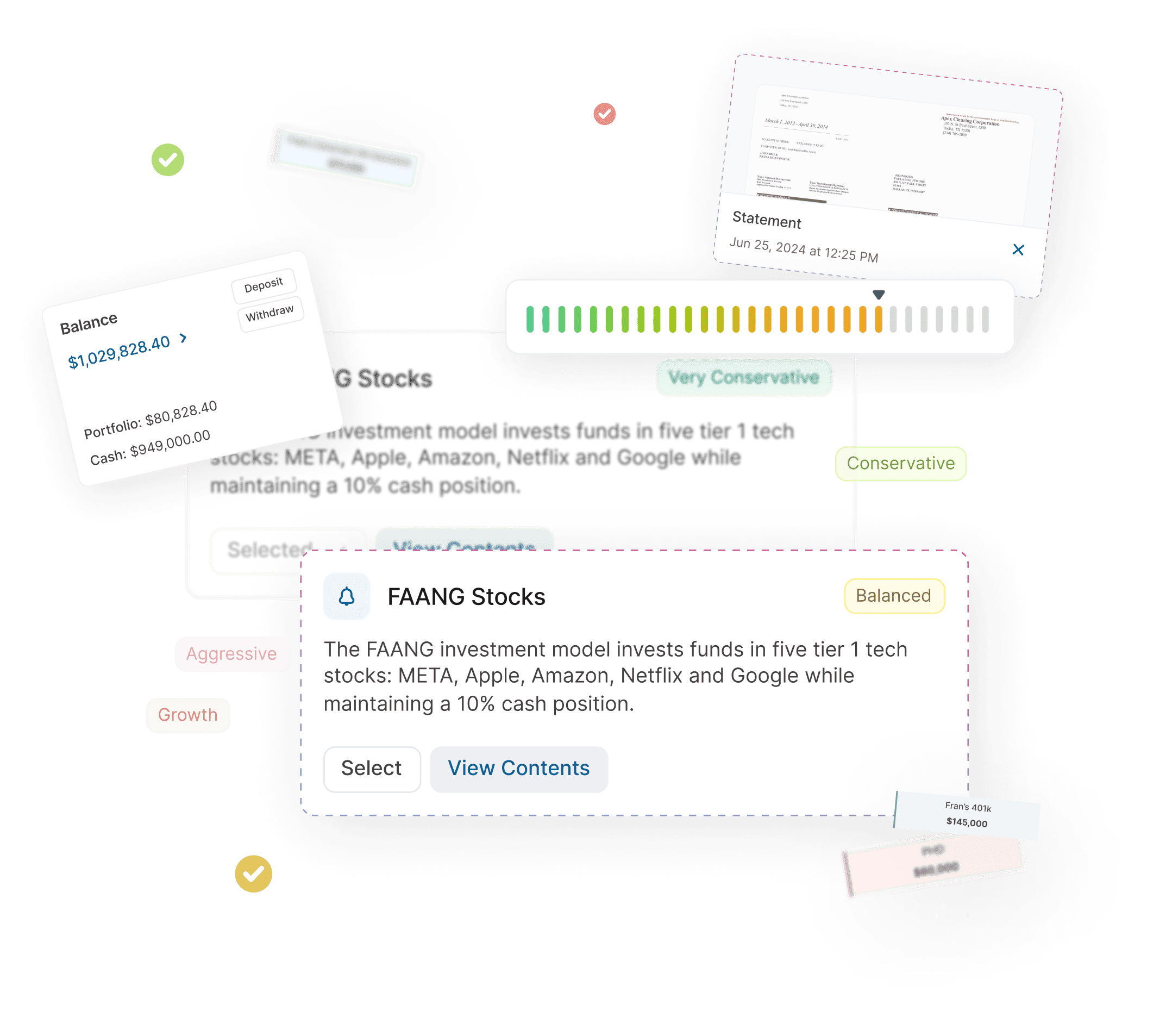

Demo RIA Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

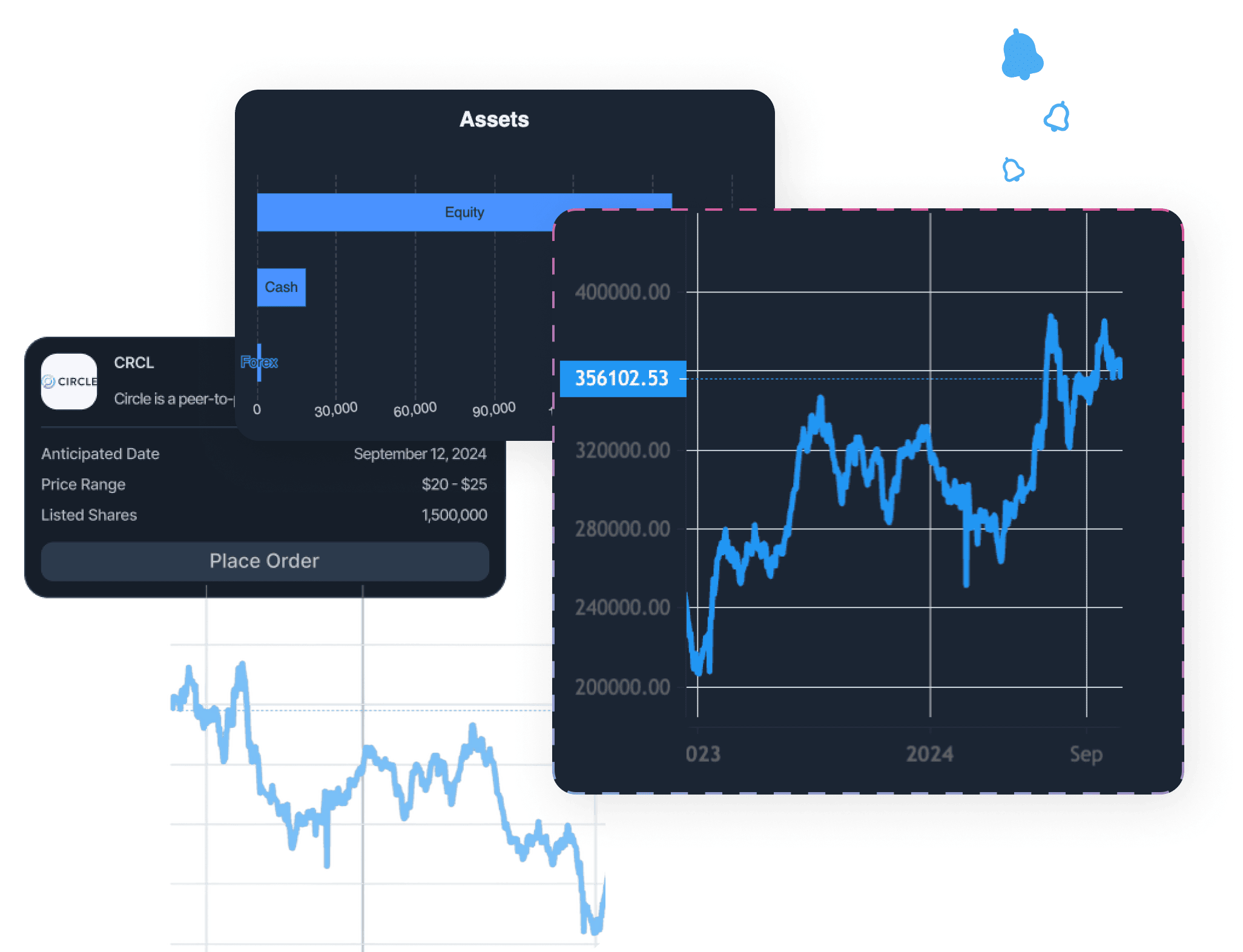

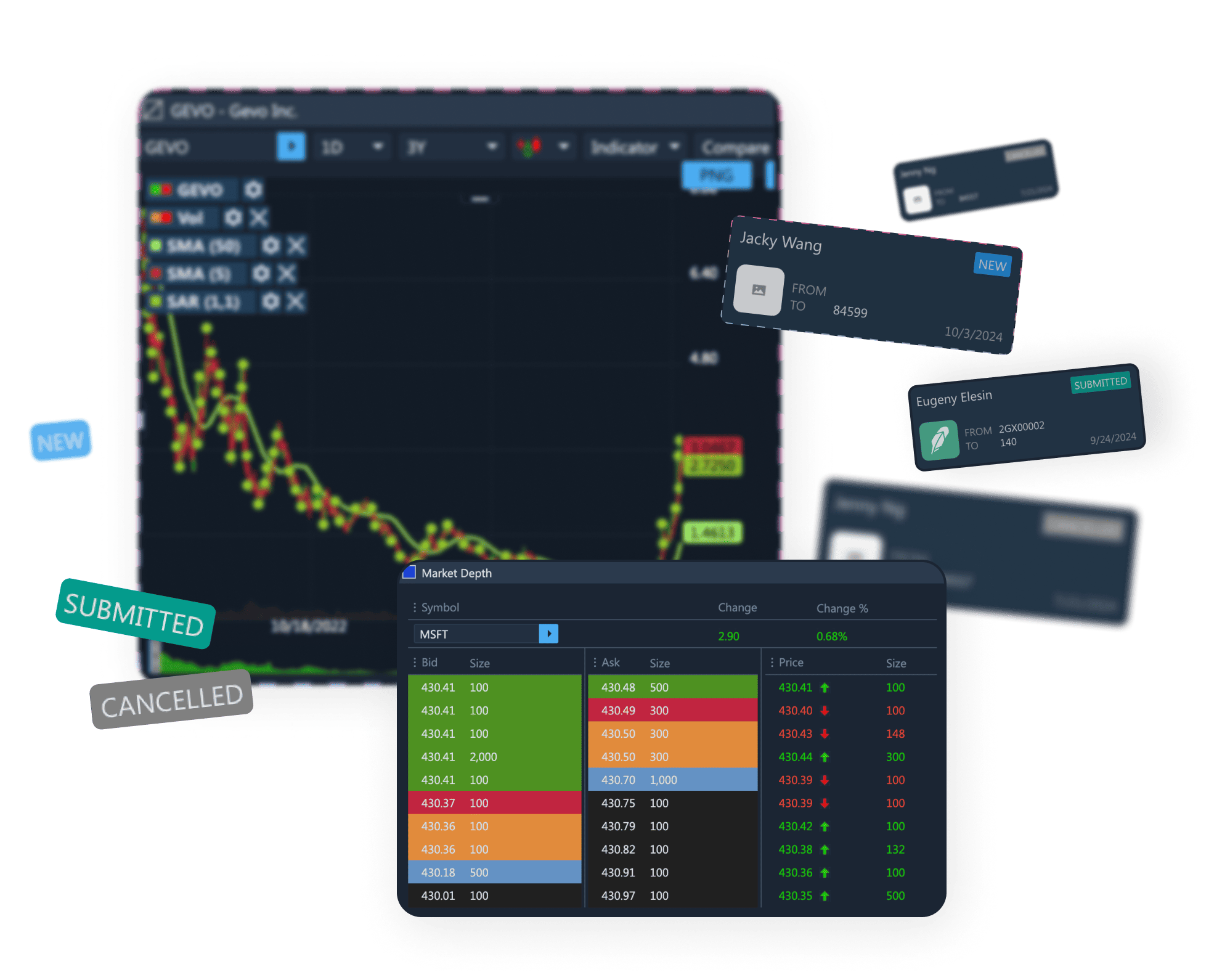

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.