05.12.2012

Most of people who use “broker-dealer” term have little understanding what does it mean and what is involved to become a broker-dealer.

Broker-dealer must hold a license and to do that he must complete 28-pages uniform application for broker-dealer registration. This application asks certain questions like:

The completed application is sent to the Security Exchange Commission (SEC), where it is reviewed and if everything is ok, the license will be issued.

Individuals who trade for their own accounts on the trading floor and the largest investments banks – all are considered to be broker-dealers. It’s very wide term, there are a lot of different types of broker-dealers:

And one more thing to be clarified – even the term “broker-dealers” refers to the license (“Form BD”), there is a difference between the “broker” and the “dealer”:

Further details: how is broker-dealer software environment designed, an overview of brokerage regulations in the US.

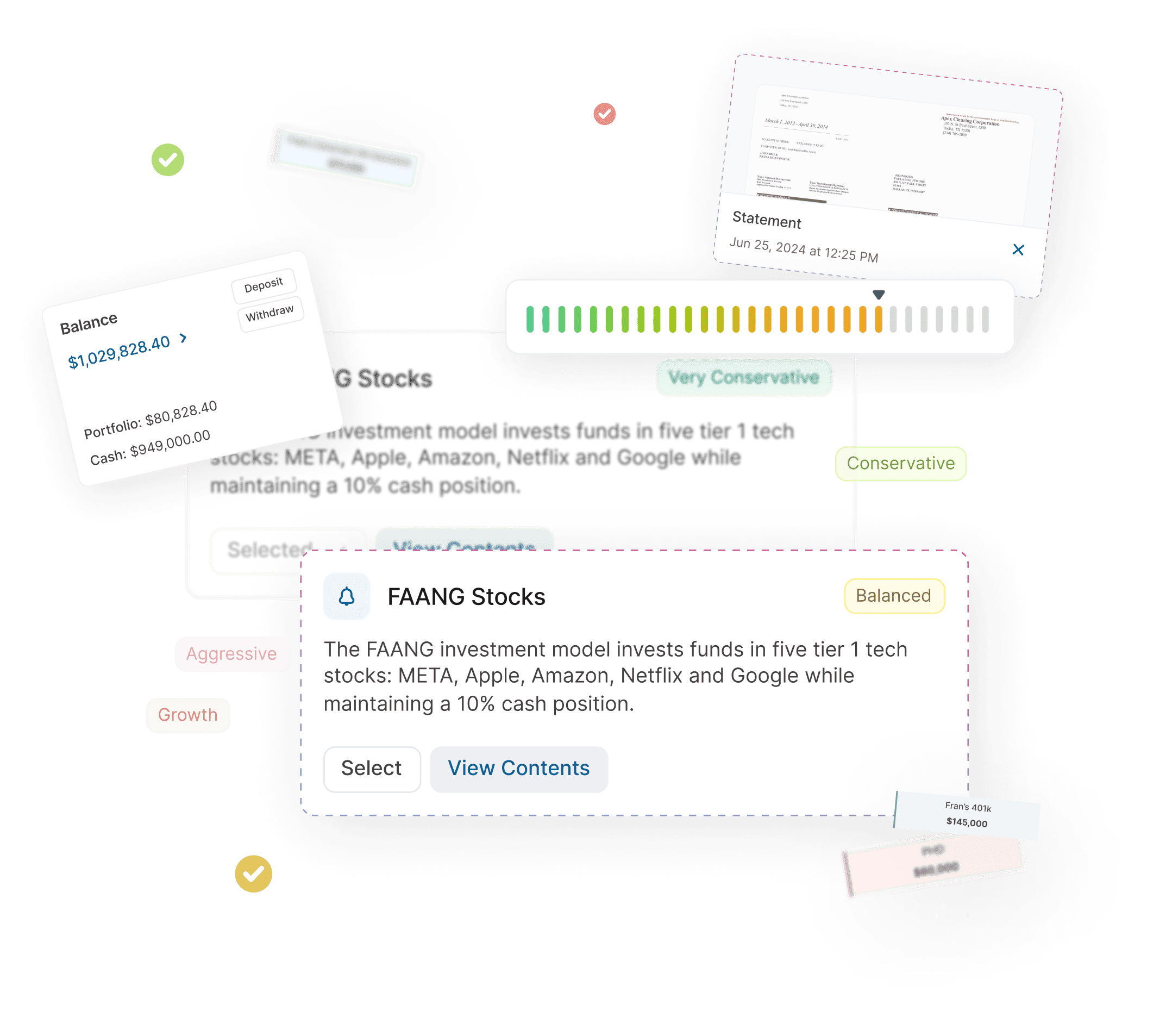

Demo RIA Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

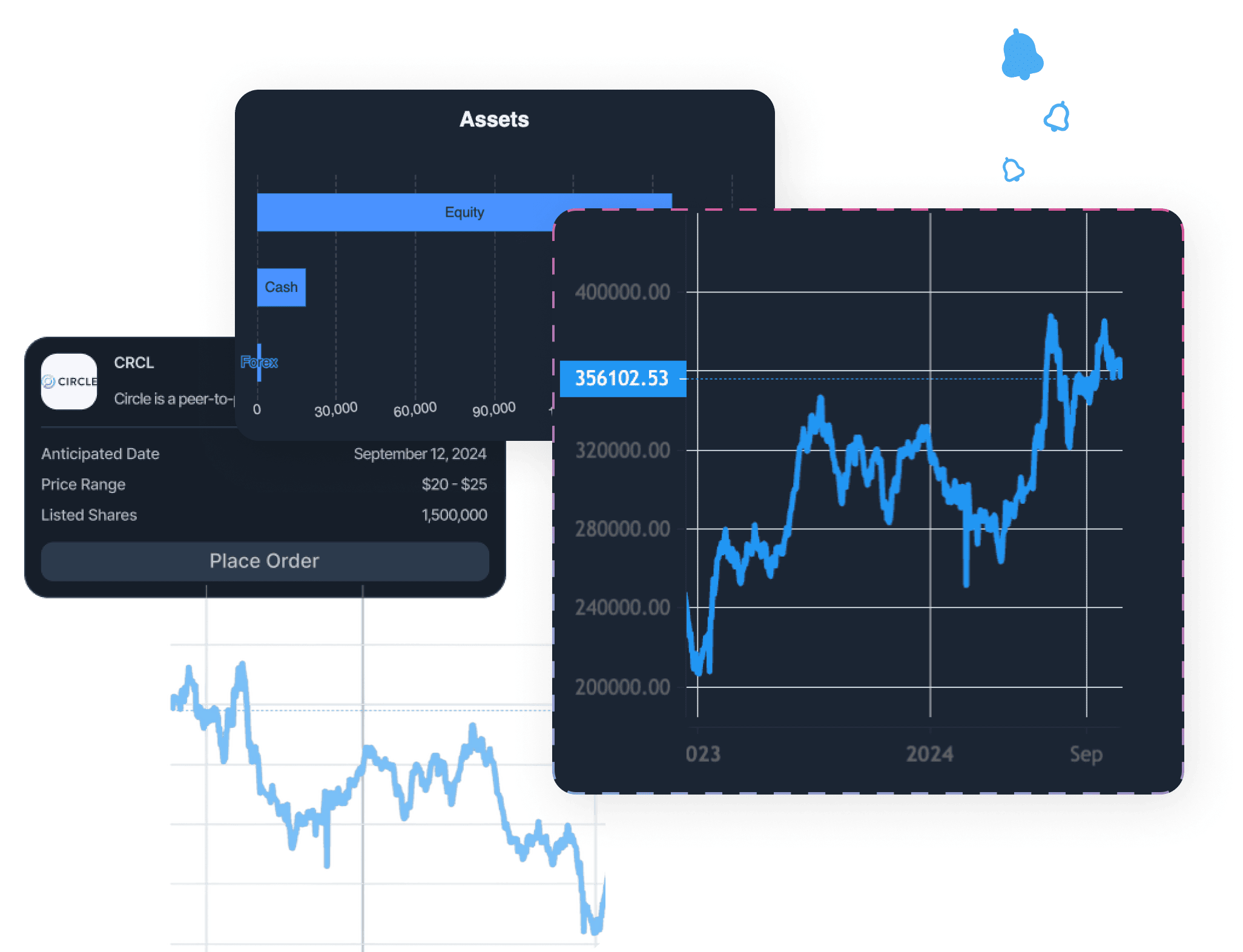

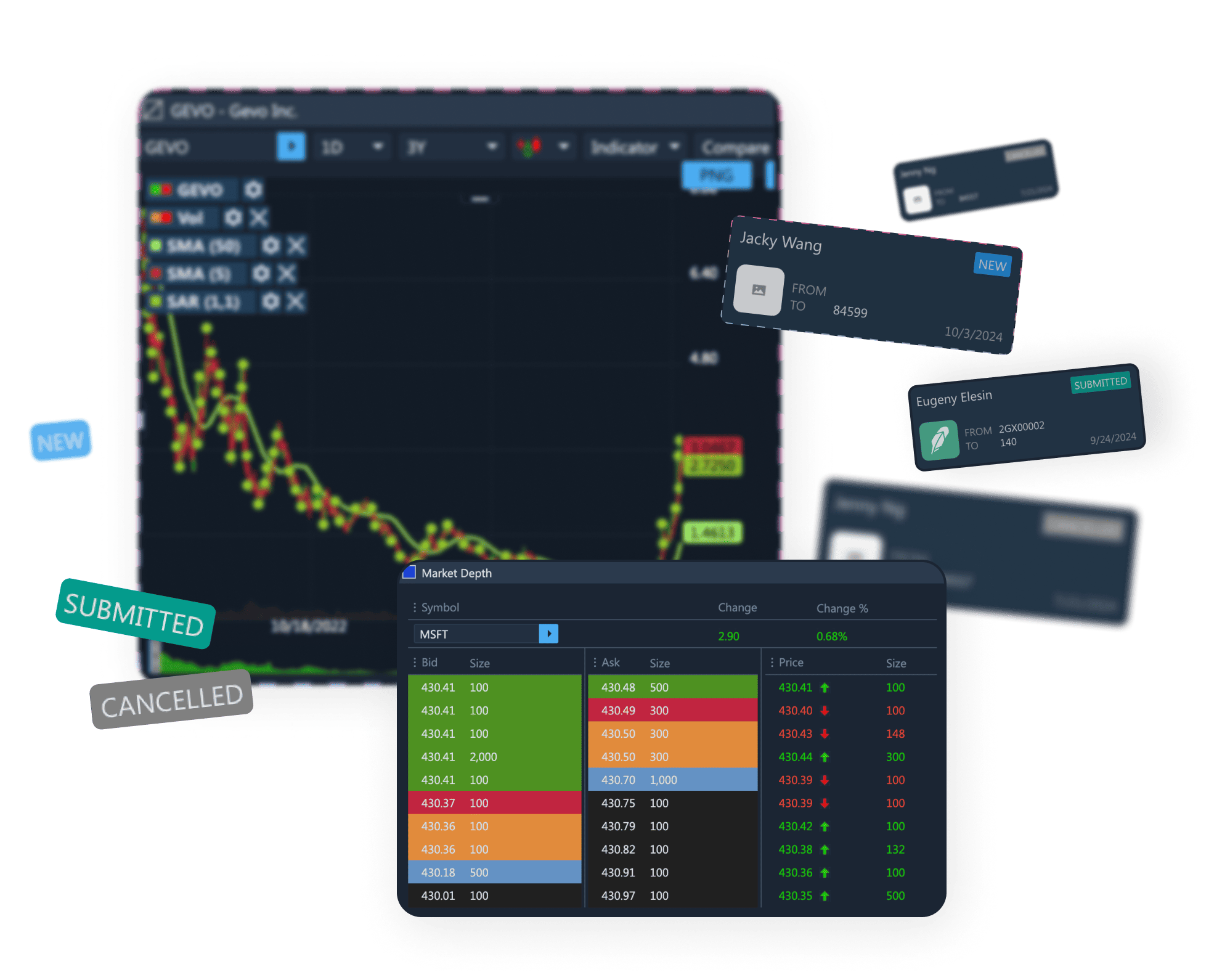

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.