01.02.2016

Trading stocks, options and Forex is far from easy—if it was, there would be no need for the financial services industry to exist at all—and very few people are born with an innate understanding of Bollinger Band analysis or the stochastic oscillator.

But the truth is, smarter investors are better investors.

Those who fully understand the intricacies of stock market trading are more likely to remain actively involved with their money than those who take more of a set-it-and-forget-it approach to their investments, and are more likely to enjoy long-term profits as a result. They’ll be better able to understand the options that exist for their money in good times and bad, and will be better equipped to make adjustments to their portfolio as needed, and they will be able to leverage the full range of financial services strategies at their disposal when making decisions about their investments.

Trading schools are a time-tested way for everyday investors to get up to speed on the possibilities of stock market trading, and these days courses can be delivered online, in person, or via a combination of both. These programs help investors not only understand what goes into modern trading strategies, but also serve to introduce many people to topics including technical analysis, Forex, margin trading, futures strategy and more, widening their investing vocabulary while simultaneously exposing them to the newest and most effective subjects in personal financial management.

And technology is transforming the world of investor education. In addition to online courses and interactive learning apps, even paper trading—the use of hypothetical trades to practice buying and selling securities without actual money being involved—has gone digital.

Given all these new tools, it has never been a better or easier time to learn about trading.

Not all trading education programs are created equal, of course, and the range of options available to prospective students right now is wide and varied. As of 2016, there are literally dozens of stock market trading schools up and running in the U.S. alone, each focusing on their own niches, whether it’s trading in stocks, futures, bonds, Forex, and more, and each offering a mix of basic investor education, advanced market strategies, mentorship, community access, and other features.

New entrants to the category not only need to stand out from this pack, but they need to bring a high quality, effective teaching product to the table as well. The truth is, there is much more to effective trading than just knowing about the markets and the strategies that are used to extract profits from them. An effective trading program needs to include all facets of the experience. You can pick up any number of investing books or spend a few hours online and learn much of what you need to know to get started in trading. But understanding strategy and the markets is just a small part of becoming a successful trader.

That said, a basic, foundational understanding of the markets themselves, as well as the strategies that traders use to profit from them, is a critical component of any trading education program.

Students should learn how to break down and analyze a stock chart, what to look for when doing technical analysis, how leading indicators work together, and how to spot a potential buying or selling opportunity on a chart or graph.

So much of the work that professional traders do can seem foreign to novices at first, so students need a firm grasp of the field’s more opaque concepts and an understanding of all the most common terms in order to fully understand how today’s trading strategies work and why. They need to be able to see what’s happening in a given trade, and what forces are working to make that trade happen.

Once students have a firm grasp of the markets they’re trading in and the most effective profit strategies for those markets, hands-on mentorship is the next step for students. That way, students are able to get an up close view of what today’s traders are really doing on a day-to-day basis and how they are finding profits in the modern markets.

At this point in the learning process, students need to be able to take the skills they’ve learned in the classroom and apply them to real-world scenarios, with an experienced trader at their side to help guide them through the process.

Educators call this “experiential learning,” but it just boils down to learning through doing, allowing students to find their way through real-world scenarios that test their understanding of the concepts they’ve learned as well as their savvy with live market action.

And, for many traders, the education process never ends. The field is constantly changing and evolving, as new market opportunities emerge, old strategies fall by the wayside, and new technologies become available to traders.

The education process should mirror this experience. Trading schools need to remain as a resource for their students, even long after they’ve gone through the program and moved on, to help them navigate the complex world of professional trading and ensure that they’re up to date on the latest tools and strategies.

As mentioned, there is quite a bit of competition in the world of trading education, and schools currently exist to serve just about every niche imaginable. The natural differentiator in this kind of environment, of course, is quality: how good is the program you offer? How well does it serve the needs of your customers?

But, in this crowded marketplace, product quality is just one part of the equation for trading school administrators. These education programs are businesses like any other, so attracting new students—like a small business looking for new customers—is key to long-term survival. Consider the following ways to attract new students to your trading school:

For investors, knowledge is power. And when it comes to the complex world of trading, many people simply don’t know what they don’t know. But by participating in a trading education program, even everyday investors can gain insights into the many ways that money is made and lost in today’s markets. With that information, they’ll be better prepared to face the ever-changing realities of today’s markets and more likely to emerge on the other side as stronger, more capable investors.

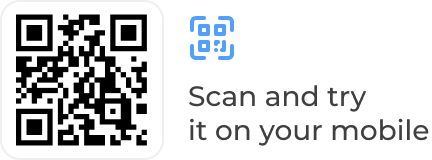

Demo RIA Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

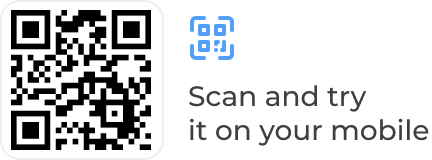

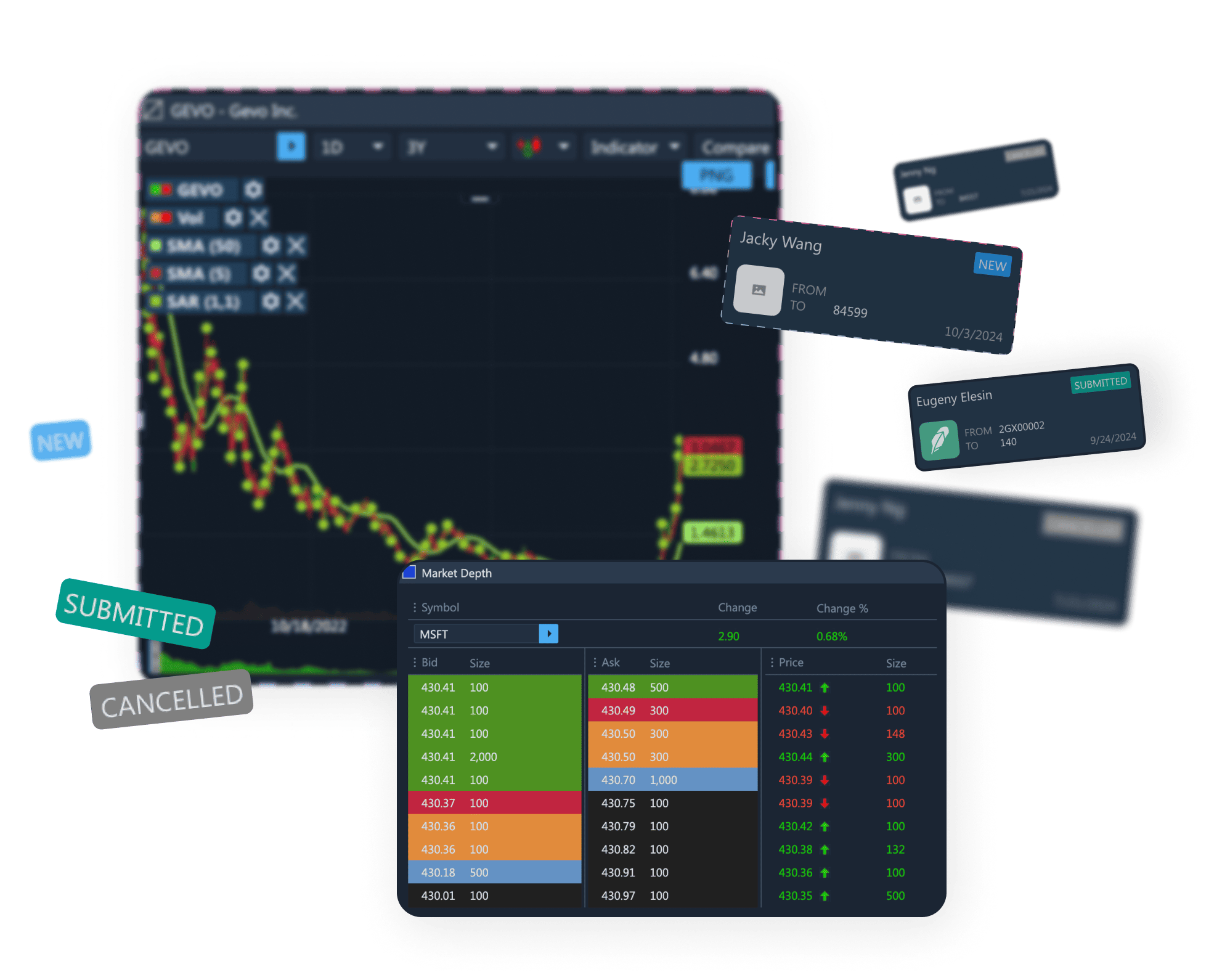

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.