22.01.2024

If so, this post for you. For those working with a single venue, you might find this information valuable for future reference.

As a broker, you’re required to submit Rule 606 reports to the SEC quarterly. While each execution venue provides its own report, the challenge lies in compiling a single report covering all venues. This process of gathering and merging data is time-consuming and error-prone.

We have partnered with industry leaders S3 and BXS Tech to develop a solution.

Our ETNA 606 Reporting Tool is designed to simplify your reporting process:

As a broker-dealer, producing clear and comprehensive Rule 606 reports signifies more than just regulatory compliance – it’s a testament to your dedication to transparency and trustworthiness in the financial sector.

Contact our team for more information on how our 606 Reporting Tool can streamline your reporting tasks and keep you compliant.

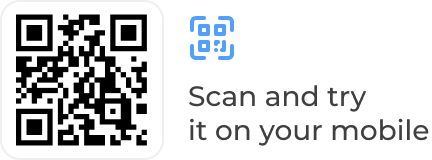

Demo RIA Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

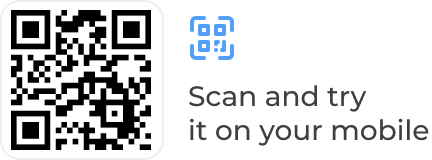

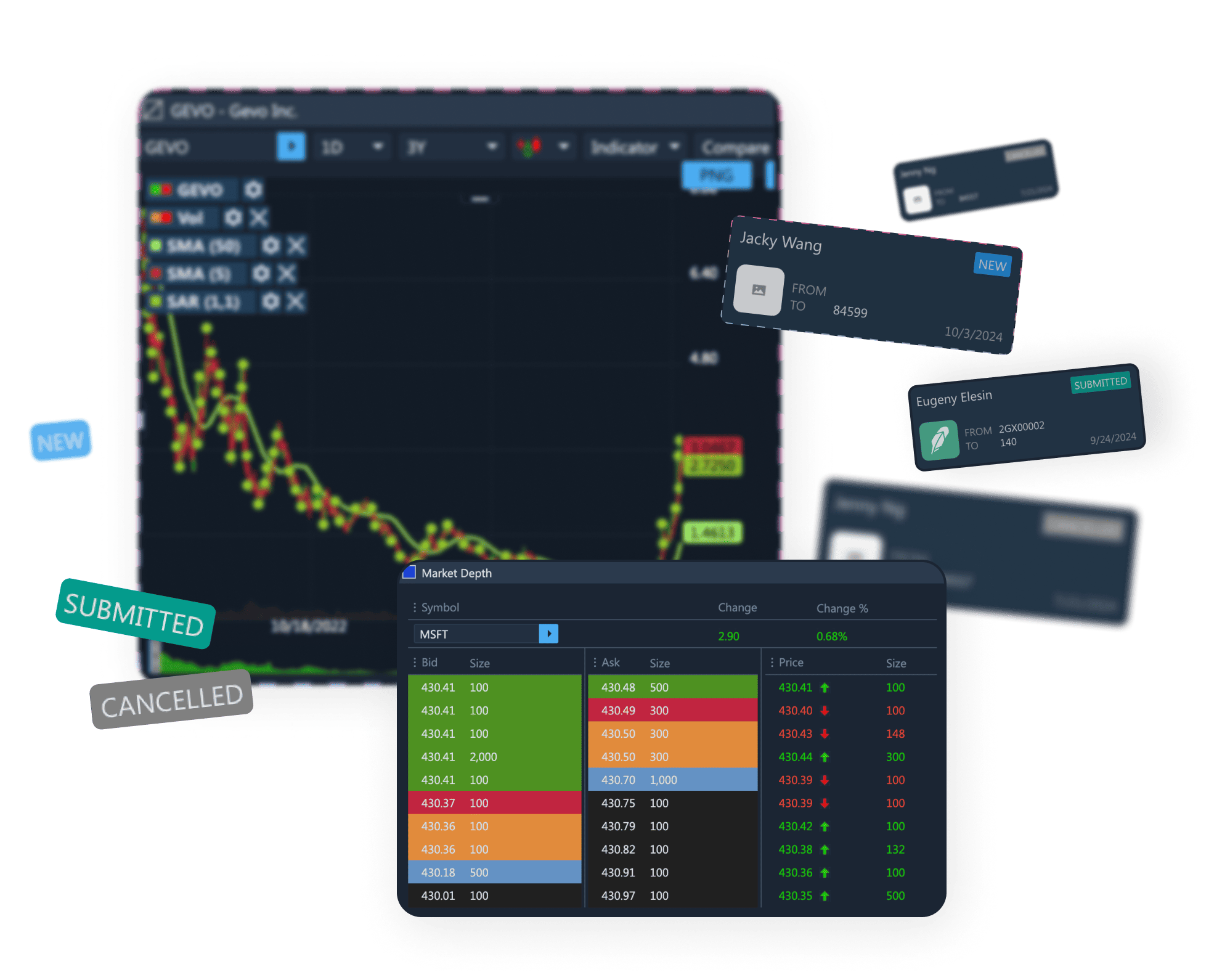

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.