10.10.2018

While trading in general started thousands of years ago, trading terminals for financial markets are far more recent. Today, we take technology for granted with smart interfaces and machines to make trades automatically and show us insights into markets and trends. But a few generations ago, things looked differently.

There were no terminals, unless you count the phone. Someone wanting to buy or sell stocks or bonds would contact a broker, who would then contact a trader in an exchange to fill the order. Some time later, confirmation of the fulfillment would come back and the price at which the trade was executed – which might have changed wildly during the time needed to make this manual process happen.

Not surprisingly, as soon as better – or at least, faster – solutions arrived, they were adopted. After the phone, there was the teleprinter that printed out stock quotes on paper tape (ticker tape). It was introduced in 1867. Delays decreased to around 15 minutes between quotes originating and being displayed.

Vintage stock brokerage desk with ticker tape machine

User friendliness and accessibility were still poor, however. You had to read along the tape to find the stock of interest to you. Teleprinters were typically only for professionals like brokers or well-to-do individuals (or their clubs). Electronic trading terminals and platforms only arrived about a century later.

In 1983-1984, Innovative Market Systems (later renamed Bloomberg L.P.) introduced its trading terminal for professionals in finance and other sectors. The Bloomberg Terminal as it is now called offered access to real-time financial market data and trading on an electronic trading platform. The Reuter Terminal is a similar product.

Usability took a timid step forward with the Bloomberg Terminal keyboard designed for traders who had no prior computer experience. The terminal also evolved to ship with Excel add-ins to make it easier to use market data, an API for developing custom functionality on top of the terminal, and connection for multiple screen displays. Pricewise, however, the Bloomberg Terminal today remains accessible only to larger customers with deeper pockets.

Before we look at later generations of trading terminals that have significantly broadened trading access, we should say a few words about phone systems. Despite touch-screen and one-click trading, voice communications are still a key part of trading activity.

Often, the bigger the trading transaction, the more ‘high touch’ it is, either in the instructions about how to execute or in discussions afterwards about the unfolding of the execution strategy. Voice communication, meaning phone communication, is often considered to give more assurance that transaction instructions (which may be complex) are correctly understood. This helps avoid potentially expensive errors.

A professional trading desk may have different phone trading terminals, such as:

Voice over IP (VoIP) solutions allow closer integration of trading applications and communications, both in physical networks and in functionality. Advanced VoIP phone systems can also include video screens for video communications and conferencing.

Internet and its associated technologies have had two big impacts on trading terminal software and financial trading in general.

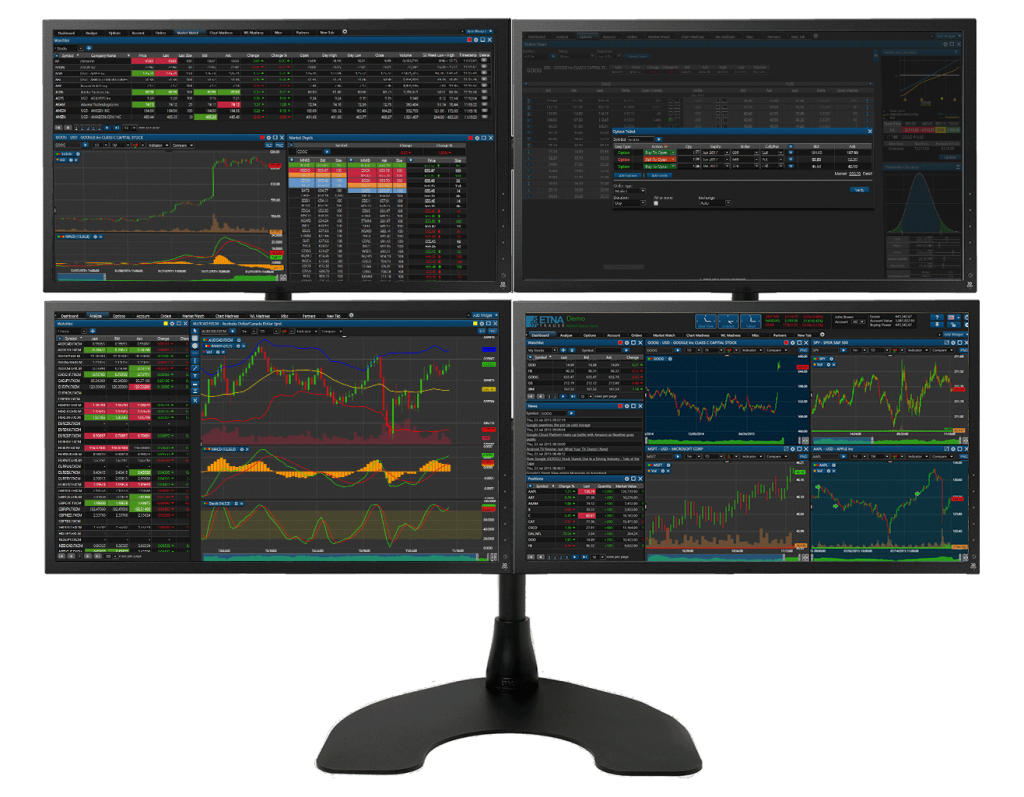

For a decade or so, the technology driving the spread of electronic trading terminals was centered on Flash, Java, and .NET. Users typically had web browsers that they could use to download standalone desktop trading applications, or that were compatible with these technologies and could run trading plugins.

White Label Online Trading Terminal

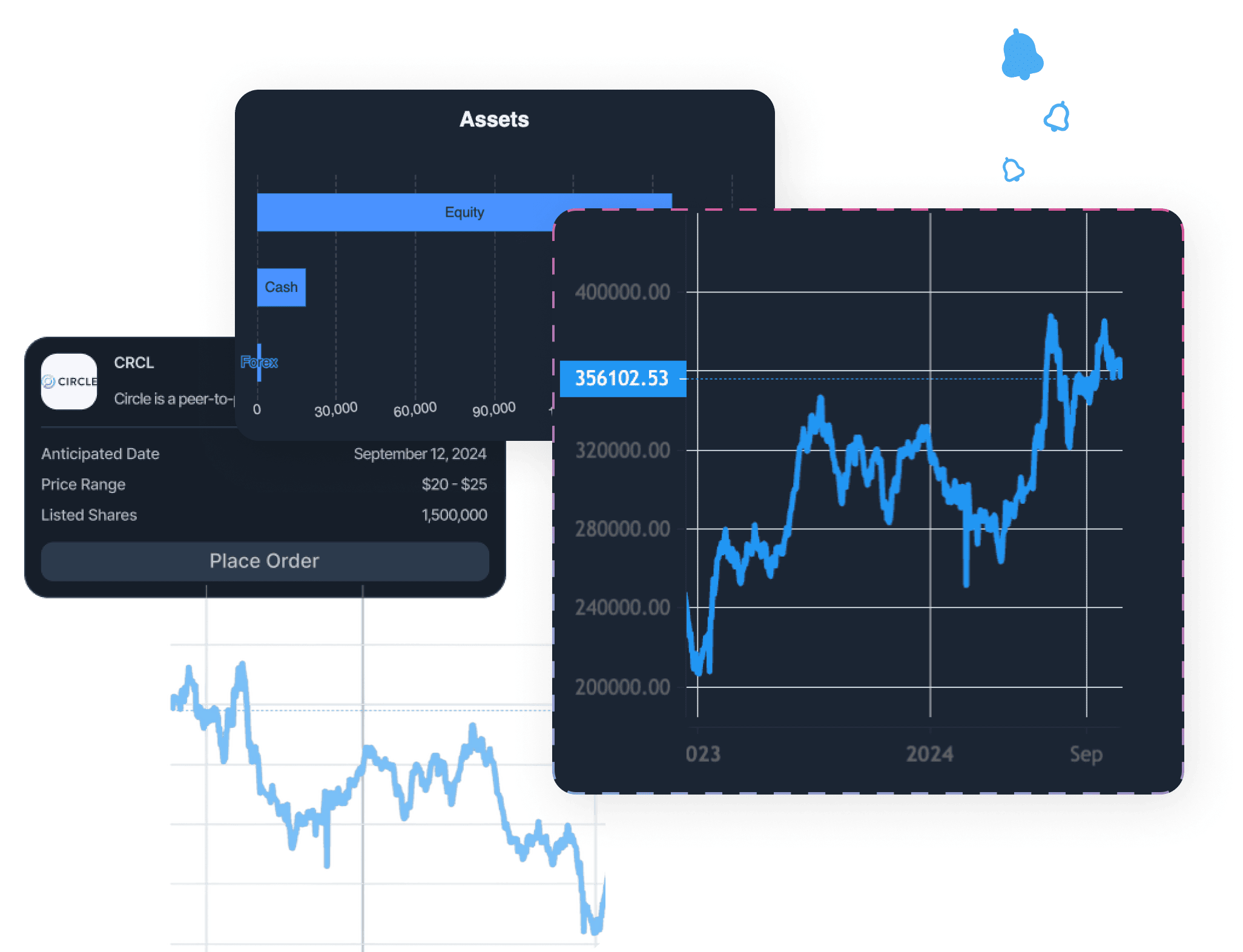

The arrival of HTML5 has simplified things further. This web markup language has the dual advantage of being lightweight and multi-platform. Most browsers, including PC and mobile, support HTML5, allowing trading interfaces to be more responsive and consistent. The user experience is dramatically improved and encouraged more users to trade, which in turn increases market liquidity and stimulates competition to provide tighter trading spreads. Well-known trading interfaces using HTML5 include ETNA Trader, which has been adopted by best online brokers in the U.S.

Mobile phones and mobile computing devices (smartphones, tablets) are natural supports for trading terminals. Users are now accustomed to doing many things on their mobile phones, banking and online shopping being just two examples. They are at ease with the technology and motivated to take control of their financial wellbeing, especially after the global financial crisis of 8-10 years ago.

The universal nature of HTML5 and responsive web design adapting to each user’s screen can go a long way to ensuring that these new trading terminals are welcoming and ergonomic. Designers can also make trading terminal apps destined for specific mobile operating systems (native apps), typically Android and iOS. The trade-offs are between ease of deployment and maintenance (HTML5-based interface) and the possibilities to access specific mobile device features, including in-device computing power (native apps).

It is also possible that ‘one size does not fit all’, either for desktop or mobile trading software. More advanced designs include possibilities to customize the trading experience for users.

Trade Positions Screen

While some users are more interested in wide-ranging charting displays and high-level performance, simplicity and social trading are also popular. Robinhood is an example of an app taking the simple-social approach. In 2015, it was also the first financial app of any kind to receive an Apple Design Award.

As business IT continues to be driven by advances in consumer IT, at least for user interfaces and peripherals, trading terminals are now extending towards voice-activated and wearable versions.

Applications like Siri (2011) have been around for some time. More recently, Amazon introduced Alexa (2014), its intelligent personal assistant. Financial companies have been experimenting with this technology for trading activities. The JPMorgan bank lets users access research via Alexa. The bank has also tested providing bond and swap information in response to voice commands.

The challenge for voice in trading terminals is in securely identifying the voice behind a command. Systems like Alexa may respond to different voices, including those in the background, for example, on a nearby TV. Currently, retail brokers Fidelity and Charles Schwab allow traders to transact by voice, although even they have not fully automated this process.

Wearable computing devices like the Apple Watch have also been attracting attention. For ‘on-the-go’ traders, the ETNA Trader AppleWatch Application offers functionality for watching price quotes, positions, and orders. The smaller screen display size means paying attention to usability and feature priorities. On the other hand, the device is part of the overall iOS operating system platform, making it easier to create and maintain trading terminal software across the Apple Watch, iPhone, iPad, and Mac desktops.

While it’s impossible to know about all the wonderful ideas from trading terminal geniuses around the world, here are some that could become mainstream in the future.

Financial trading has as much to gain from new technology as any other activity. While users already have the advantages of performance and usability of trading interfaces using HTML5 on desktop and mobile computing devices, you can expect to see new developments in computing reflected sooner rather than later in trading terminals.

Electronic and voice trading terminals will continue to coexist, at least in larger institutions. AI will become an integral part of trading terminals, although more as a support for better trading rather than replacing traders themselves. We’ve already come a long way from the teleprinter of the previous century. Over the next decade, things may change significantly yet again.

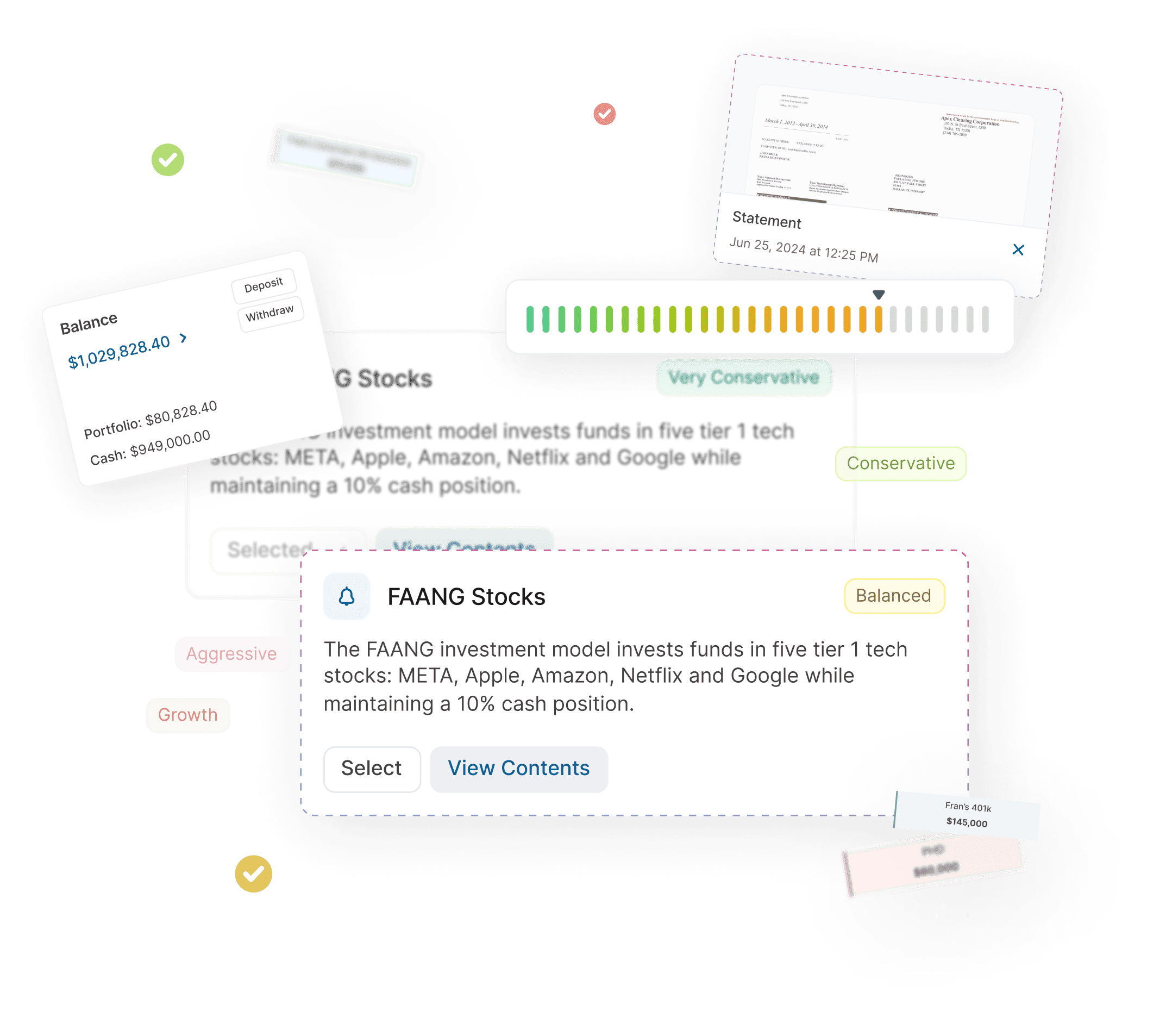

Demo RIA Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

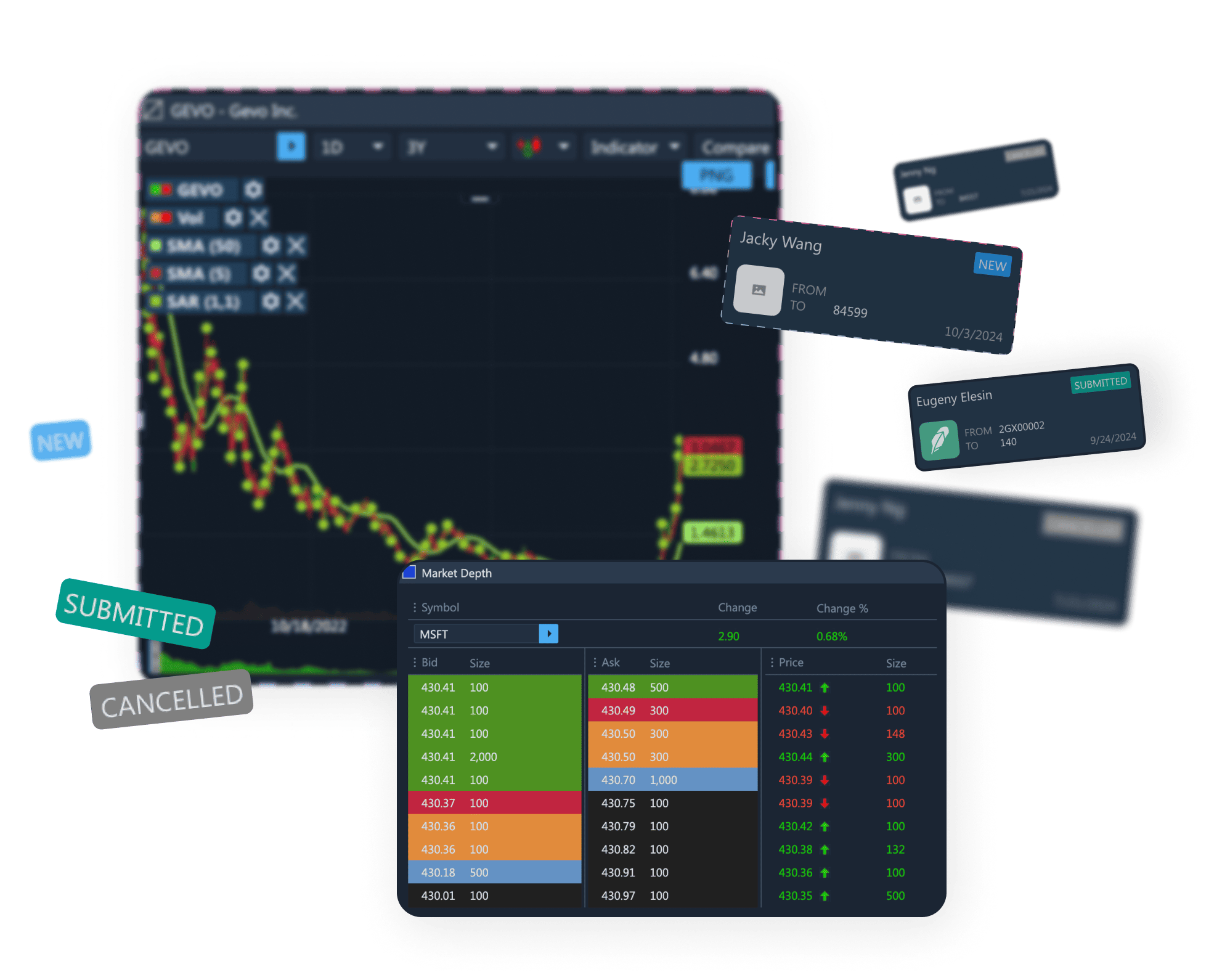

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.