13.03.2018

From high-frequency trading to long-term investing, computer algorithms are taking over online investment sector at a breathtaking speed. The modern technology, exponential growth of AI and machine learning has made it possible for wealth managers to provide digital financial advice using robo-advisor software to their clients and created a whole new division in FinTech – WealthTech.

Since the 2008 financial crisis, the traditional financial advisors have been in the limelight for poor performance and lack of transparency despite charging exorbitant fees. This has prompted investors to turn to robo-advisor platforms, which are not only cheaper, but have proven to perform better. According to BI Intelligence forecast, the global assets under management (AUM) by robo-advisors will reach $8 trillion by 2020. Another study by Accenture shows that the majority of wealthy investors now prefer a mixture of human advisor and robo-advisor software.

Robo-advisor software

While wealth managers recognize the need of having a digital strategy in place, the majority are still on the sidelines given the costs and the complexity of implementing such solutions. Building a robo-advisor software from scratch is costly and takes away the precious time from focusing on the business side. A lot of financial firms still think that building a quality financial application is possible only in-house and requires a specialized IT team on payroll. And most of the boutique investment firms can not afford it.

However, there exist other affordable and efficient opportunities that most of the investment advisors are missing out.

Below we gathered a few tips on how to launch to a robo-advisor software platform and bring traditional advising business online.

Step 1. Build a customer facing application

First things first. Unique algorithms, web and mobile experience are the essential points of your business, a storefront of your business, something that lets you stand out from the competition. Start with outlining how and when customer will interact with your robo-advisor software solution. It is worth building it from scratch. Often times firms entering the robo-advising space have already working algorithms and a customer base, and so the challenge is to digitize it.

Customer Facing Portal for Robo-Advisors

Fortunately the rise of mobile and web technologies made it easier than ever to build user-friendly software applications and frontends. It takes less time to build sophisticated responsive frontends by APIs, white label software and various frameworks even in the FinTech industry. Charts, watchlists, chats and chatbots, social media functionality, news widgets and many more, – these things are standard, and there are only so many ways to build them. So, why reinventing the wheel? Look for APIs and white label components to build your robo-advisor software faster and cheaper. Some of these components are free, some are available on a subscription basis for a small fee, and there are even open source libraries which offer great opportunities for customization. Choose what works best for your business model.

If your technological background is limited and making such decisions is not your cup of tea, our advice is to hire the FinTech consultant, an agency or an independent Project Manager to create a specification for you first, or even a prototype of a platform. A good technical specification is 80% of the success, plus it will be easier later to hire an independent developer or a development firm to build your application if you choose so.

Step 2. Back Office and Trade Execution

Once you figure out a working algorithm and user experience, it’s time to focus on setting up trading capabilities and connect your frontend to an OMS/EMS and the back office. There are a few options here.

The FinTech revolution and a quick adoption of API technology has brought to us amazing white label software products and platforms that can be integrated and connected to pretty much any frontends. While these options still require some IT expertise and effort, it is much less complex and cheaper.

Step 3. Grow your business

Launching a robo-advisor software is only first step to success. It facilitates reaching out to new customers and improves the loyalty among your existing clients demonstrating that your business is up to date, it evolves and adapts to the modern reality.

However to truly bring your business online and capitalize on your new robo-advisor software, take your time to work on your marketing launch plan.

Depending on what are the demographics of your client base, pick a strategy to tell a story about your brand, educate and prepare your clients to this transition. Older people prefer phone calls and reading, so invest time into phone calls and creating quality text guides. Younger audiences prefer video content and informal communication, and there are many affordable ways to deliver this. Organize seminars and educating meetups.

As the AI and machine learning continue to advance, there are opinions that digital financial advisors will replace traditional advisors with robo-advisor software in the nearest future. While there is a likelihood of that, as technology optimists we think a hybrid model is more realistic. Technology can be a powerful tool when used wisely, it can complement the service of a traditional advisor, make operations more efficient and widen the customer audience looking for an automated financial advice.

Contact ETNA today to learn how we help online investing businesses launch new products and grow.

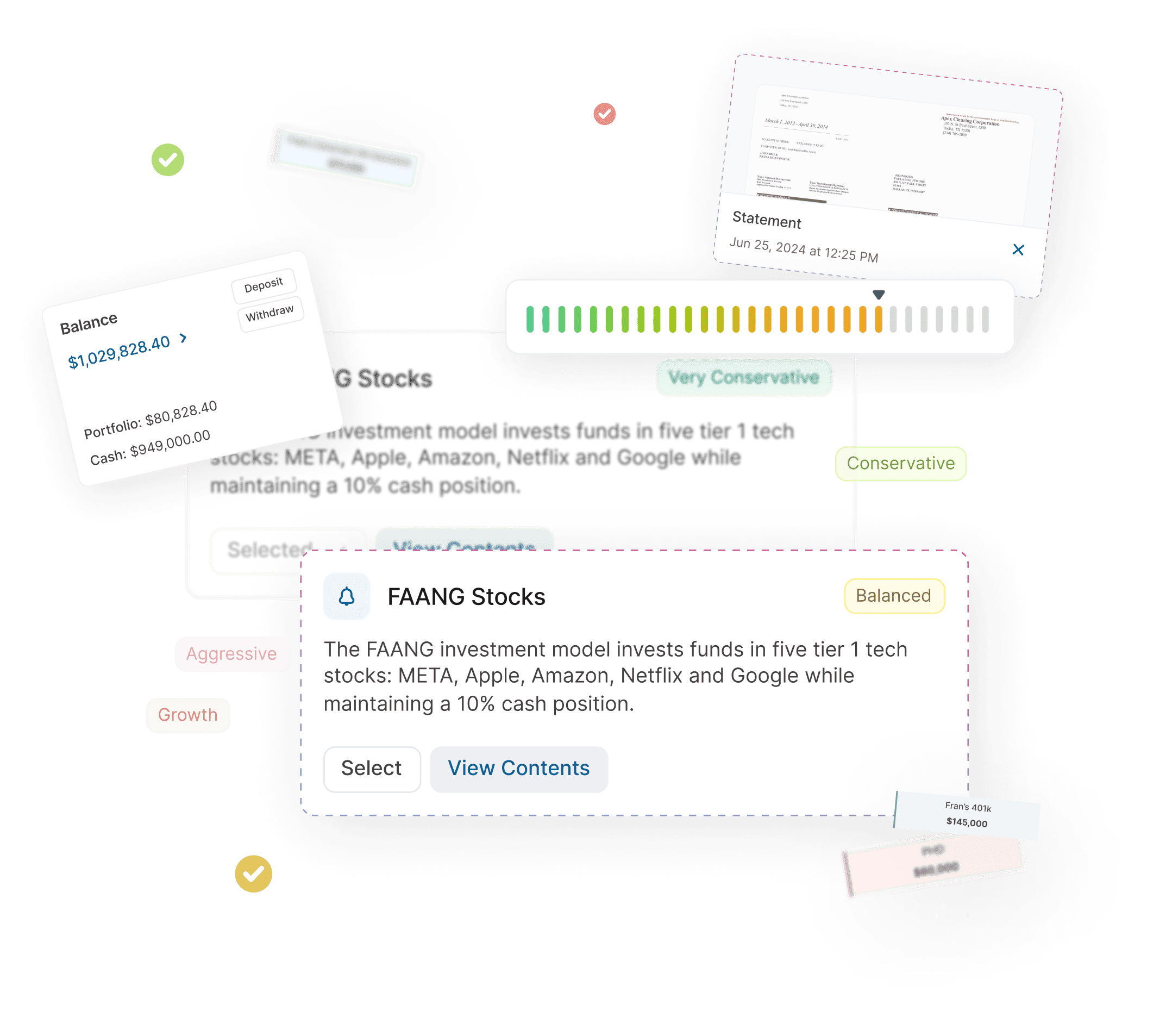

Demo RIA Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

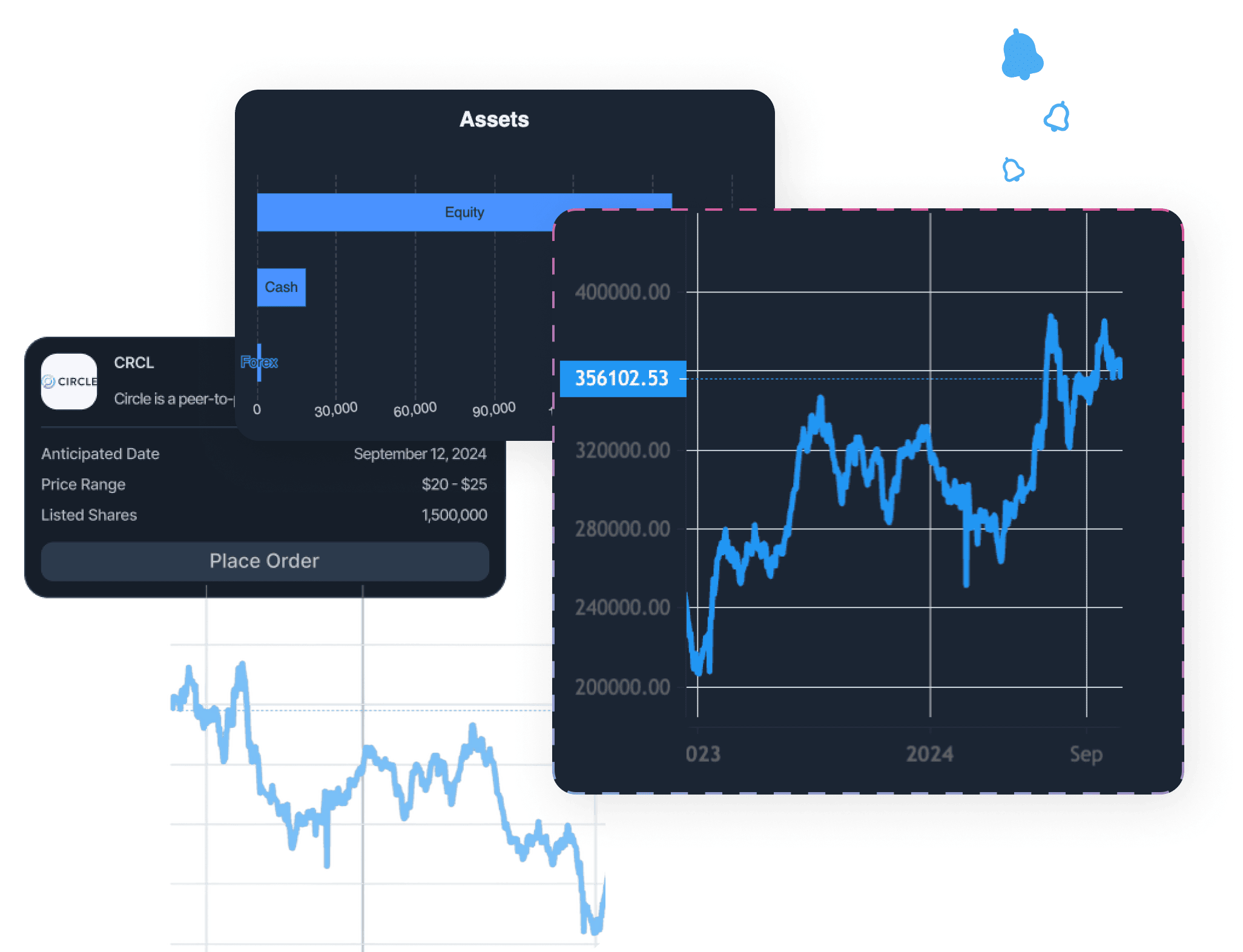

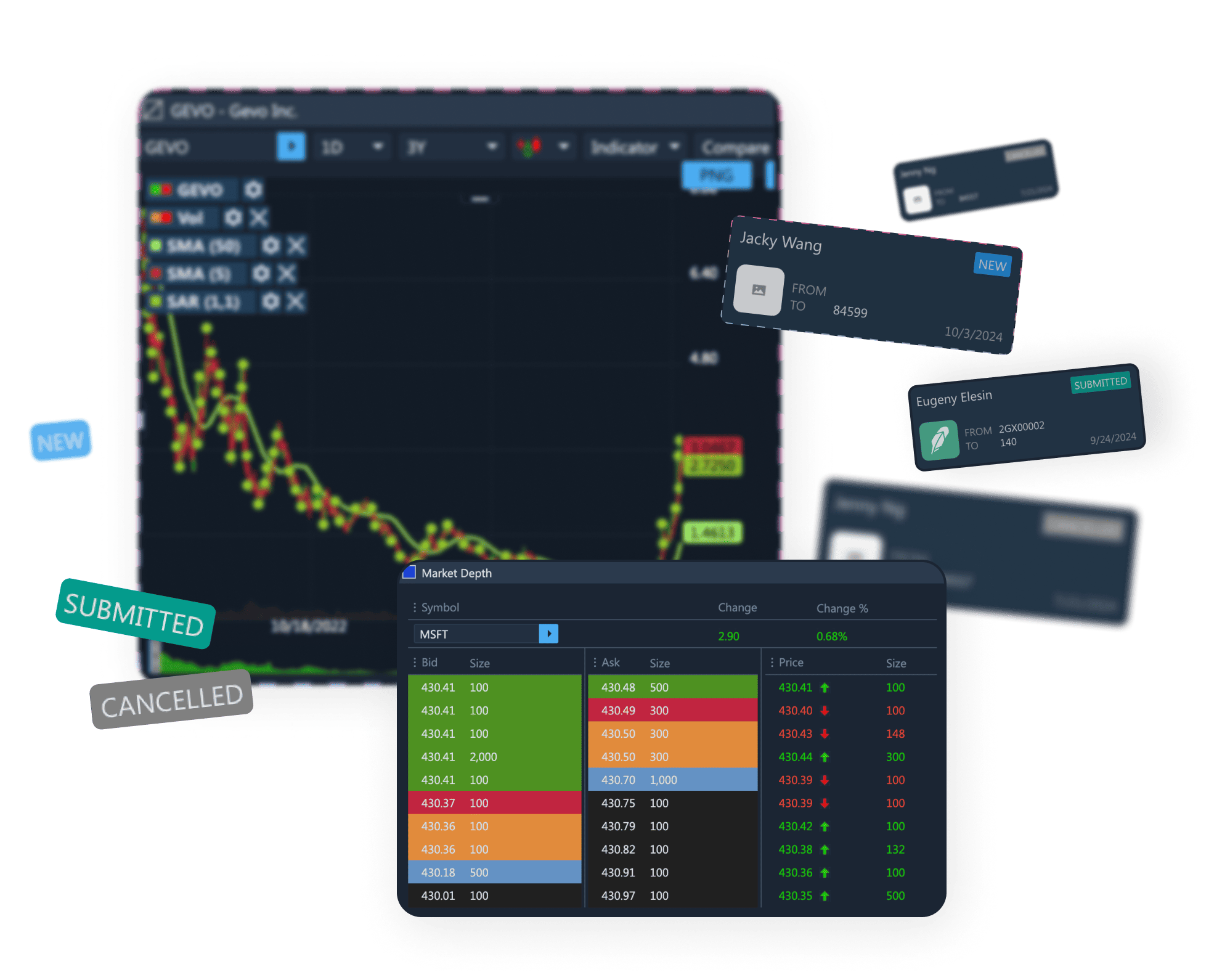

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.