02.08.2018

Broker-dealer regulation in the U.S. is tight. And rightly so. After all, whether brokers work with stocks, currencies, bonds, or other financial instruments, broker-dealers often handle large amounts of money, including other people’s. Naturally, the U.S. government wants to keep bad actors out and maintain investor confidence. So, whether you plan to start your activity as a broker-dealer or you’ve already begun, be prepared for red tape – all in a good cause, of course.

Broker-Dealer Regulation

If you’re wondering if you qualify, see if your professional activities match any of the following. Among other things, broker-dealers may underwrite financial securities, including initial public offerings (IPOs), do financial market research, make markets by buying and selling financial instruments, and manage customer accounts for buying and selling. The Securities Exchange Act of 1934 defines a broker as being engaged in effecting transactions in securities for others, and a dealer as a buyer and seller of securities for its own account (via a broker or otherwise). Many firms are both brokers (working for customers) and dealers (competing with customers), which makes them ‘broker-dealers’.

The two laws that are the cornerstones of broker-dealer regulation are the Securities Act of 1933 and the Securities Exchange Act of 1934. Since then, there have been more with others yet to come. The list below is not exhaustive but will give you an idea of the current legal framework.

Depending on what services you offer, different broker-dealer regulations may apply. For example, if your market includes customers in Europe, you may also need to show compliance with the recently enforced General Data Protection Regulation (GDPR).

In general, brokerage firms in the U.S. are regulated by:

You will need to check the specific broker-dealer regulation for any state in which you want to exercise broker-dealer activities. Examples of organizations with a nationwide impact are:

SEC (Securities and Exchange Commission)

SEC (Securities and Exchange Commission)

This federal government agency regulates broker-dealers, IPOs, and securities exchanges, working with SROs to guarantee compliance. It handles related criminal matters.

The SEC enforces the rules that all market participants must comply with. Among other responsibilities, the SEC is in charge of:

Brokers have an obligation to notify the SEC about changes in capital, organizational structure, and any observed frauds.

FINRA Building in New York City

Every broker-dealer must select a Self-Regulatory Organization (SRO). If there is one SRO you work with, it is likely to be FINRA. Before 2007 the most known SROs were:

Brokers who conducted business at the NYSE have selected NYSE as their SRO; brokers who conducted business on the CBOE would choose the CBOE to be its SRO. And broker-dealers who are not a member of an exchange have chosen the NASD. In 2007, SEC approved the merger of the NYSE’s and NASD’s regulation department to form the FINRA (Financial Industry Regulatory Authority) which now is the largest Self-Regulatory Organization in the U.S.

Broker-dealer regulation of SROs follow the federal rules; and these rules include, but are not limited to:

FINRA also performs periodic audits of broker-dealers. These audits review firms’ internal procedures and applications. The firms’ books and records are verified to be compliant with FINRA’s rules.

SEC and FINRA rules:

Other SROs are:

MSRB (Municipal Securities Rulemaking Board) that makes broker-dealer and other trading municipal securities.

CBOE (Chicago Board Options Exchange) which regulates options trading.

NFA (National Futures Association) is the self-regulatory organization for the U.S. derivatives industry, including on-exchange traded futures, retail off-exchange foreign currency and OTC derivatives.

In general, a company will need to accomplish the following steps before it can do business as a broker-dealer:

Most SROs require that associated persons of broker-dealer companies pass one or more exams related to their specific financial activities, before they can do business with investors (individual or corporate):

And there are others! In addition, note that to uphold their license to operate, brokers may need to complete education classes periodically to stay up to date in regulatory matters and new securities offerings and client services.

Getting registered is just the start. Broker-dealers also have ongoing duties of financial responsibility, customer protection, and good conduct. Here are a few highlights:

Broker Back Office Technology

With the the development of technologies and the rise of self-directed online investors, broker-dealer regulation activities are being automated too. Technology can help reduce workloads, accelerate reporting and, last but not least, eliminate human error. It can also help broker-dealers to stay safe in the face of mounting cyber threats on their IT systems and networks.

There is a whole industry nowadays for regulatory technology, often known as RegTech. It includes separate applications for specific processes like reports generation, KYC or AML, or it can be all built in the broker back office application.

We can only give an overview here of the U.S. broker-dealer regulation rules and laws. Federal and state government organizations, SROs, and other regulatory bodies have detailed descriptions of the rules to be followed. Be sure to determine all the regulations that apply to you and seek professional advice as needed. Fortunately, there are outsourced regulatory compliance consultants that specialize on providing expert help to financial services firms.

ETNA has been setting up broker-dealers across U.S. and Canada with the most advanced trading technology for years. ETNA Trader is a broker-dealer out-of-the-box technology that allows to launch an online trading platform within days. Contact us to learn why 30% of the best online broker-dealers in the U.S. chose ETNA Trader.

Demo RIA Software

Manage portfolios with advanced rebalancing and real-time insights.

Access customizable client reports and streamlined compliance tools.

Designed for advisors seeking efficient client and portfolio management.

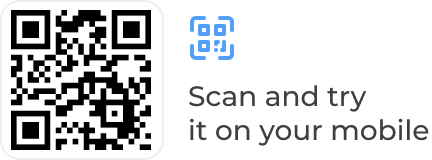

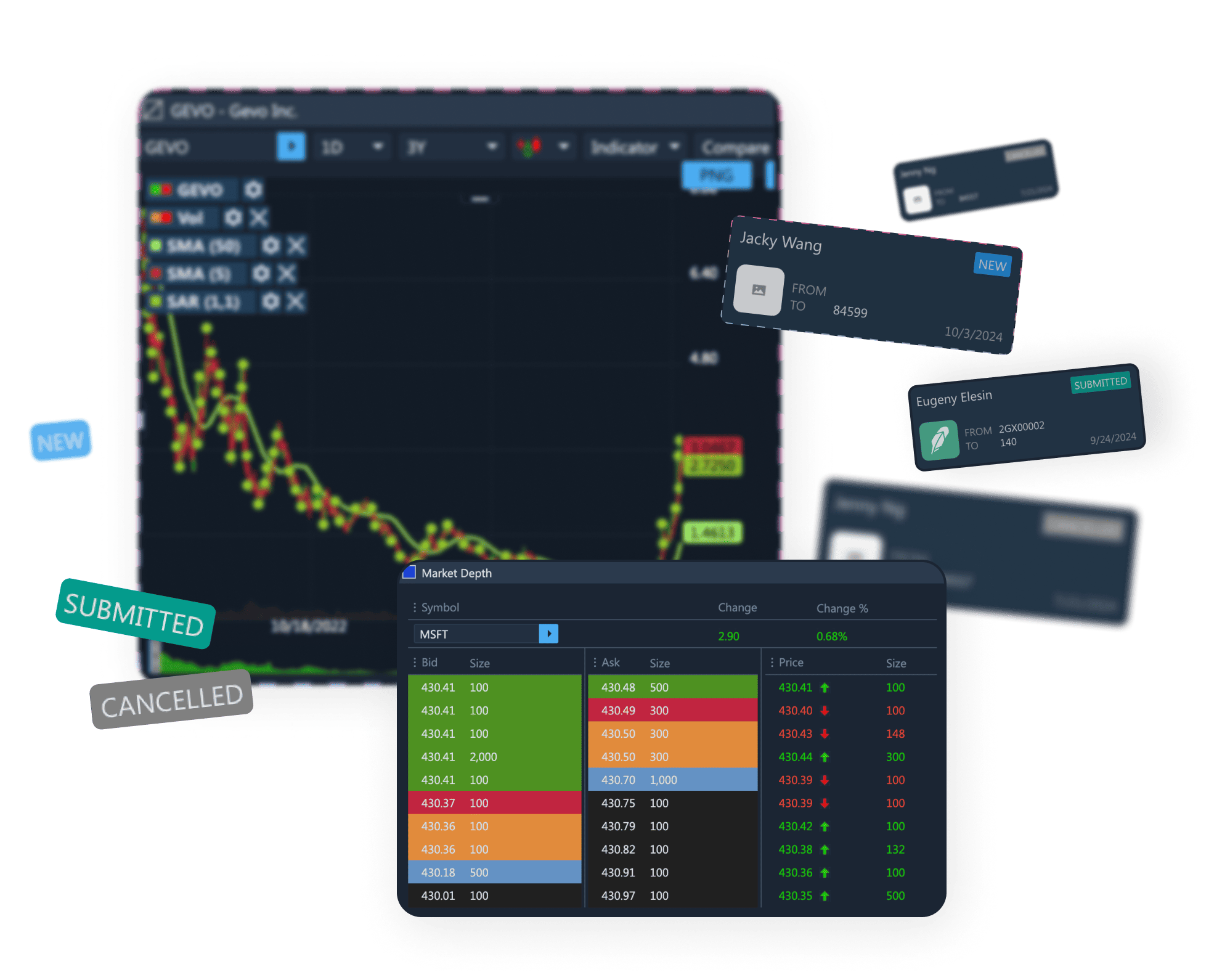

Demo Advanced Trading Platform

Test multi-asset strategies with real-time and historical data.

Analyze market depth, execute complex options, and algorithmic orders.

Ideal for refining strategies and risk management before live trading.

Demo Paper Trading Platform

Practice trading with virtual funds in real market conditions.

Simulate cash, margin, and day-trader accounts to gain experience.

Perfect for honing skills in a risk-free, customizable environment.